Taxes on Lottery Winnings

Lottery winnings are considered taxable income in the United States, both at the federal and state level.

Federal Taxes:

-

Tax Rate: The federal tax rate on lottery winnings is progressive, meaning it increases as your winnings climb. In 2024, the highest federal tax bracket sits at 37%. So, if you win a massive jackpot and take the lump sum payout, you could be looking at owing nearly 40% in taxes!

For example:

- If you win a small amount (under $5,000), you wouldn't owe any federal taxes because there's no withholding and it likely wouldn't push you into a higher tax bracket.

- If you win a larger amount that pushes you into the highest bracket (37%), you'd owe 24% withheld initially, then the additional 13% on the remaining amount when you file your taxes.

-

Withholding: The good news is, lottery agencies are required to withhold 24% of all winnings exceeding $5,000 for federal taxes. This acts as a down payment on your tax bill.

-

Tax Bracket: The remaining tax you owe depends on your total taxable income for the year, which includes your lottery winnings and any other income sources. If your lottery winnings push you into a higher tax bracket, you'll owe the additional tax on that portion of your winnings.

-

Lump Sum vs. Annuity: The way you choose to receive your winnings can impact your tax burden. Taking the lump sum will likely push you into a higher tax bracket for that year. Opting for the annuity option spreads the payout over time, potentially keeping you in a lower tax bracket each year.

State Taxes:

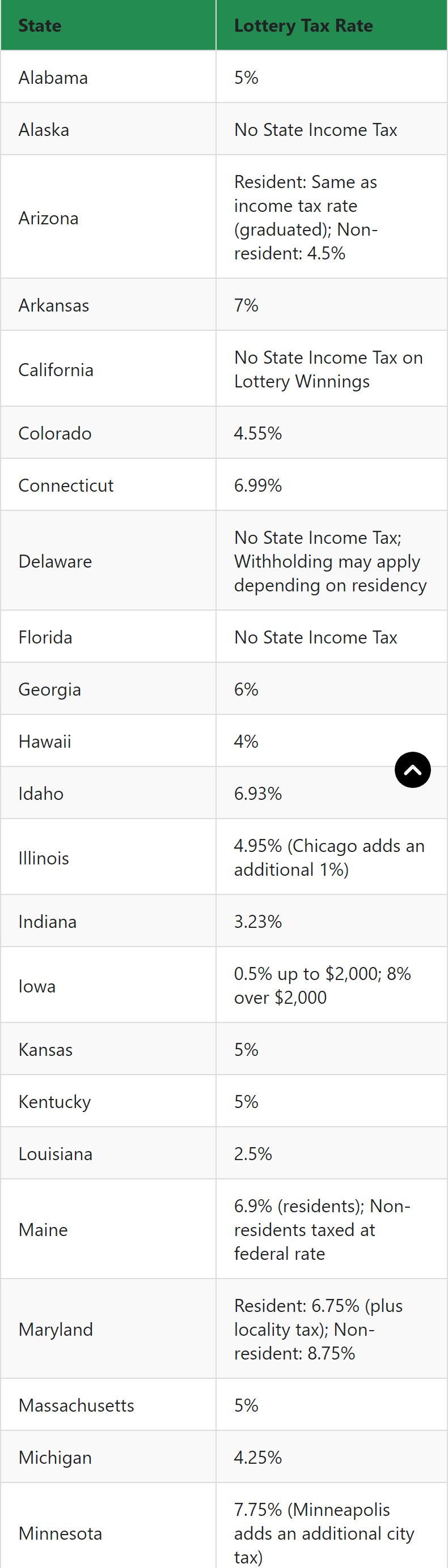

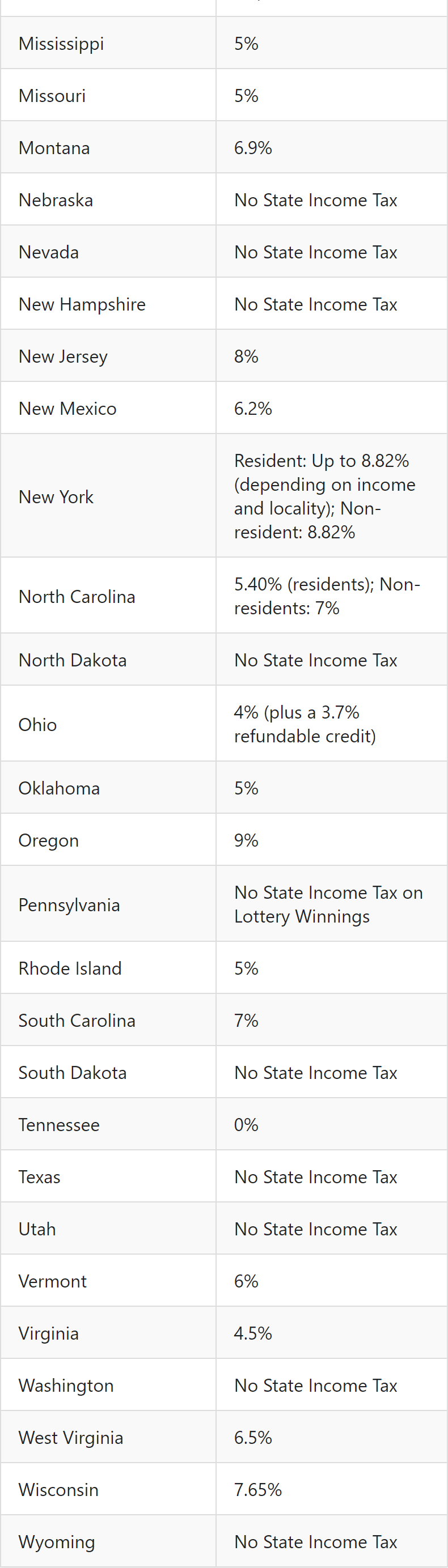

On top of federal taxes, most states levy their own taxes on lottery winnings. These rates vary widely, ranging from 0% to over 8%.

Here is a table to give you an idea:

| State | Lottery Tax Rate |

|---|---|

| Alabama | 5% |

| Alaska | No State Income Tax |

| Arizona | Resident: Same as income tax rate (graduated); Non-resident: 4.5% |

| Arkansas | 7% |

| California | No State Income Tax on Lottery Winnings |

| Colorado | 4.55% |

| Connecticut | 6.99% |

| Delaware | No State Income Tax; Withholding may apply depending on residency |

| Florida | No State Income Tax |

| Georgia | 6% |

| Hawaii | 4% |

| Idaho | 6.93% |

| Illinois | 4.95% (Chicago adds an additional 1%) |

| Indiana | 3.23% |

| Iowa | 0.5% up to $2,000; 8% over $2,000 |

| Kansas | 5% |

| Kentucky | 5% |

| Louisiana | 2.5% |

| Maine | 6.9% (residents); Non-residents taxed at federal rate |

| Maryland | Resident: 6.75% (plus locality tax); Non-resident: 8.75% |

| Massachusetts | 5% |

| Michigan | 4.25% |

| Minnesota | 7.75% (Minneapolis adds an additional city tax) |

| Mississippi | 5% |

| Missouri | 5% |

| Montana | 6.9% |

| Nebraska | No State Income Tax |

| Nevada | No State Income Tax |

| New Hampshire | No State Income Tax |

| New Jersey | 8% |

| New Mexico | 6.2% |

| New York | Resident: Up to 8.82% (depending on income and locality); Non-resident: 8.82% |

| North Carolina | 5.40% (residents); Non-residents: 7% |

| North Dakota | No State Income Tax |

| Ohio | 4% (plus a 3.7% refundable credit) |

| Oklahoma | 5% |

| Oregon | 9% |

| Pennsylvania | No State Income Tax on Lottery Winnings |

| Rhode Island | 5% |

| South Carolina | 7% |

| South Dakota | No State Income Tax |

| Tennessee | 0% |

| Texas | No State Income Tax |

| Utah | No State Income Tax |

| Vermont | 6% |

| Virginia | 4.5% |

| Washington | No State Income Tax |

| West Virginia | 6.5% |

| Wisconsin | 7.65% |

| Wyoming | No State Income Tax |

Step-by-Step Calculation Process for Lottery Tax Calculator

This outlines the calculation process for a lottery tax calculator online tool:

Inputs:

- Advertised Lottery Winning Amount (USD)

- State Name (Selected from a dropdown menu with all US states)

Outputs:

- Lottery Lump Sum Payout After Tax

- Actual Winning Before Tax (considering withholding)

- Federal Tax Withheld

- State Tax

- Net Winning After Tax

- Annuity Payout Table for 30 Years

Calculation Process:

-

Federal Withholding:

- Access a pre-defined database containing federal withholding rate (currently 24%)

- Calculate the federal withholding amount:

Federal Withholding = Advertised Winning Amount * 0.24

-

Actual Winning Before Tax:

- Subtract the federal withholding from the advertised amount:

Actual Winning = Advertised Winning Amount - Federal Withholding

- Subtract the federal withholding from the advertised amount:

-

State Tax Calculation:

- Access a database containing state lottery tax rates for all US states.

- Based on the selected state, retrieve the corresponding state tax rate.

- Calculate the state tax amount:

State Tax = Actual Winning * State Tax Rate

-

Net Winning After Tax:

- Subtract both federal and state taxes from the actual winning amount:

Net Winning = Actual Winning - Federal Withholding - State Tax

- Subtract both federal and state taxes from the actual winning amount:

-

Lump Sum Payout After Tax:

- This is the final amount the user receives after all taxes are deducted:

Lump Sum Payout = Net Winning

- This is the final amount the user receives after all taxes are deducted:

Example:

- Advertised Winning Amount: $10,000,000

- State: California (No State Income Tax on Lottery Winnings)

- Federal Withholding: $10,000,000 * 0.24 = $2,400,000

- Actual Winning Before Tax: $10,000,000 - $2,400,000 = $7,600,000

- State Tax: Since California has no state tax on lottery winnings, State Tax = $0

- Net Winning After Tax: $7,600,000 - $2,400,000 = $5,200,000

- Lump Sum Payout After Tax: $5,200,000

Federal and state tax for lottery winnings on lump sum and annuity payments in the USA

Federal Taxes:

-

Progressive Tax Rates: Unlike a flat tax, the federal tax rate on lottery winnings increases as your winnings climb. In 2024, the highest rate is 37%. Think of it like climbing a ladder - the higher the winnings, the higher the tax bracket you reach, and the higher the percentage you owe.

-

Withholding: Lottery agencies are required to withhold 24% of all winnings exceeding $5,000 for federal taxes. This acts as a pre-payment on your tax bill, similar to how taxes are withheld from your paycheck.

-

Lump Sum vs. Annuity Payments: This can significantly impact your tax burden. Let's look at examples for both:

-

Lump Sum: Imagine you win a $10 million jackpot and choose the lump sum option. This would likely push you into the highest tax bracket (37%). Here's the breakdown:

- Withholding: 24% withheld initially, meaning you receive $7.6 million upfront.

- Taxes Owed: When you file taxes, you'll owe the remaining 13% on the full $10 million. This translates to $1.3 million. So, after taxes, you'd have roughly $6.3 million remaining.

-

Annuity: If you opt for the annuity option, the winnings are spread out over a period, typically 20 or 30 years. This can potentially keep you in a lower tax bracket each year.

- Example: Let's say your annuity payout is $500,000 per year for 20 years. If your other income throughout those years doesn't push you into a higher bracket, you might only owe the 24% withheld initially (around $120,000 per year). This could result in a significantly larger take-home amount compared to the lump sum option, depending on your overall income situation.

-

Important Note: These are simplified examples. Consult a tax professional for personalized advice, especially with large winnings.

State Taxes:

On top of federal taxes, most states levy their own taxes on lottery winnings. These rates vary widely, ranging from 0% to over 8%. Here's how state taxes apply to lump sum and annuity payments:

-

Lump Sum: The full amount of your winnings is subject to the state's tax rate in the year you receive it.

-

Annuity: Similar to federal taxes, each year's annuity payout is subject to the state's tax rate in that specific year.

Example:

Imagine you win a $10 million jackpot and live in a state with a 6.85% lottery tax.

- Lump Sum: You'd owe the state an additional $685,000 on top of federal taxes.

- Annuity: If your annual payout is $500,000, you'd owe the state roughly $34,250 every year you receive the payment.

Remember: Check your specific state's lottery tax rate to estimate your tax liability.

Most lottery winners want a lump sum payment immediately. Then, they can choose to invest it into a retirement plan or the other stock option to generate a return. The main benefit of a lump sum is getting complete access to the funds.

All individuals, accountants, economic advisors, wealth managers, and lawyers also love to take lump-sum amounts. The winner wants to take the whole amount because they can use it to buy stocks or a company.

Many monetary advisors suggest selecting the lump sum because you typically get a bigger return on investing lottery winnings in huge gain assets.

You can also get knowledge about the taxes applied to your winnings using a lottery tax calculator.

Alabama state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 5%

Alaska state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

Arizona state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: Resident: Same as income tax rate (graduated); Non-resident: 4.5%

Arkansas state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 7%

California state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

Colorado state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 4.55%

Connecticut state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 6.99%

Delaware state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

Florida state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

Georgia state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 6%

Hawaii state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 4%

Idaho state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 6.93%

Illinois state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 4.95% (Chicago adds an additional 1%)

Indiana state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 3.23%

Iowa state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0.5% up to $2,000; 8% over $2,000

Kansas state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 5%

Kentucky state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 5%

Louisiana state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 2.5%

Maine state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 6.9% (residents); Non-residents taxed at federal rate

Maryland state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: Resident: 6.75% (plus locality tax); Non-resident: 8.75%

Massachusetts state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 5%

Michigan state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 4.25%

Minnesota state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 7.75% (Minneapolis adds an additional city tax)

Mississippi state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 5%

Missouri state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 5%

Montana state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 6.9%

Nebraska state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

Nevada state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

New Hampshire state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

New Jersey state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 8%

New Mexico state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 6.2%

New York state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: Resident: Up to 8.82% (depending on income and locality); Non-resident: 8.82%

North Carolina state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 5.40% (residents); Non-residents: 7%

North Dakota state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

Ohio state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 4% (plus a 3.7% refundable credit)

Oklahoma state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 5%

Oregon state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 9%

Pennsylvania state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

Rhode Island state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 5%

South Carolina state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 7%

South Dakota state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

Tennessee state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

Texas state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

Utah state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

Vermont state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 6%

Virginia state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 4.5%

Washington state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

West Virginia state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 6.5%

Wisconsin state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 7.65%

Wyoming state tax on lottery winnings in the USA

Federal Tax: 25%

State Tax: 0%

References :

- https://worldpopulationreview.com/state-rankings/taxes-on-lottery-winnings-by-state

- https://smartasset.com/taxes/how-taxes-on-lottery-winnings-work

- https://www.investopedia.com/managing-wealth/winning-jackpot-dream-nightmare/